Introduction: The Heartbeat of Customer Service

In today’s fast-paced world, the insurance industry faces a myriad of challenges, from rising customer expectations to the need for rapid response times. Amidst these evolving demands, one element remains crucial for the success of any insurance company: an efficient call center. But is it truly a must-have? Let’s dive in and explore the undeniable importance of call centers in the insurance sector.

Unpacking the Value: More Than Just a Contact Point

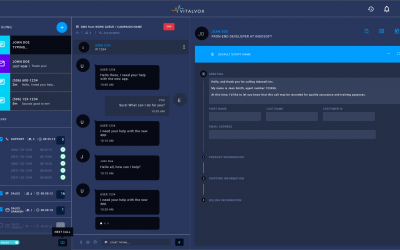

Immediate Support, Lasting Impressions

At the core of the insurance business lies a promise – to be there for clients when they need it the most. Call centers fulfill this promise by providing immediate assistance, whether it’s for policy inquiries, claims processing, or emergency support. This immediacy not only resolves issues quickly but also builds lasting customer trust and satisfaction.

Personalized Interactions in a Digital World

Despite the surge in digital communication, the human touch remains irreplaceable. Call centers offer personalized support that algorithms and automated responses cannot match. They understand nuances, empathize with customer situations, and provide tailored solutions, enhancing the customer experience manifold.

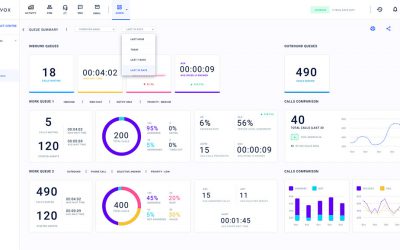

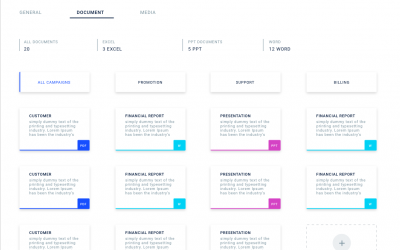

Data Insights for Informed Decisions

Beyond customer service, call centers are goldmines of data. Every call provides insights into customer needs, preferences, and pain points. Insurance companies can leverage this data to refine their products, services, and customer interaction strategies, staying ahead in a competitive market.

The Ripple Effect: Beyond Immediate Benefits

Enhanced Customer Loyalty

Satisfied customers are loyal customers. By addressing concerns promptly and effectively, call centers significantly boost customer loyalty. This loyalty translates into repeat business, positive word-of-mouth, and a stronger brand reputation.

Operational Efficiency

Call centers streamline operations by categorizing and directing calls to the appropriate departments. This efficiency reduces wait times, increases resolution speed, and optimizes resource allocation, allowing companies to serve more customers without sacrificing quality.

Risk Management and Compliance

In the insurance industry, compliance with regulations is non-negotiable. Call centers play a pivotal role in risk management and compliance, ensuring that all customer interactions adhere to legal standards and company policies, thereby safeguarding the company’s integrity and customer trust.

The Final Verdict: Essential, Not Optional

In conclusion, call centers are not just beneficial but essential for insurance companies aiming for success. They serve as the frontline in customer service, offering immediate support, personalized interactions, and invaluable data insights. The ripple effects of an effective call center extend beyond customer satisfaction to include enhanced loyalty, operational efficiency, and compliance with regulations.

So, to answer the question: Is a call center a must-have in the insurance industry? Absolutely. It’s the heartbeat of customer service, pumping vitality into every facet of the business.

Elevate Your Customer Service Game

Investing in a robust call center is your first step toward achieving unmatched customer satisfaction and operational excellence. Shape it today by enhancing your call center capabilities. Your customers deserve the best, and so does your business. Don’t wait for the future to dictate your success—reach out to us today

Categories

- Agent Performance & Training

- AI solutions

- Asterisk

- Business Growth

- Call Center Performance & Productivity

- Call Center Software Platform

- Call Center Technology & AI Integration

- Call Center Training

- Call Center Workforce Management

- Call Monitoring

- Cloud-Based Solutions

- Customer Experience

- Data Security

- General

- Insights

- Integrated Customer Service

- News

- Omnichannel Communication Strategy

- Omnichannel Support

- Quality Assurance

- Tech