The workforce impact and the future of AI in financial services are reshaping how companies operate and compete. With AI automating tasks, enhancing decision-making, and transforming customer interactions, it is crucial to understand the implications for employees and businesses alike. This evolution is not just about adopting new technologies—it’s about adapting the workforce to thrive in this new era of innovation.

Workforce Impact of AI in Financial Services

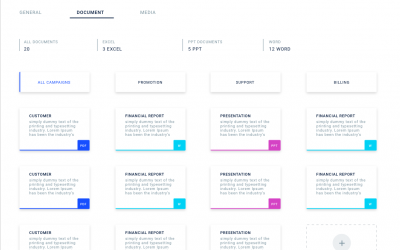

The workforce impact of AI is most evident in its ability to automate repetitive tasks. For example, activities like data entry, fraud detection, and basic customer inquiries are increasingly managed by AI. As a result, employees can focus on higher-value tasks, such as strategic planning and building customer relationships.

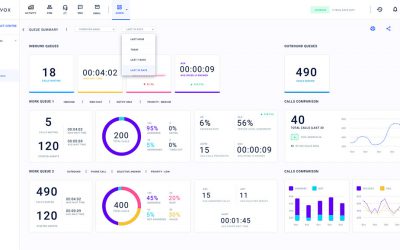

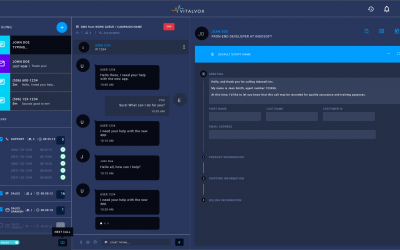

Moreover, AI improves efficiency by streamlining processes across departments. For instance, AI-powered chatbots now handle customer queries 24/7, enabling human agents to address more complex issues. Additionally, algorithms process vast datasets quickly, uncovering insights that drive better decision-making. However, this shift also requires reskilling the workforce to meet the demands of a technology-driven environment.

Key Benefits Shaping the Future of AI

- Enhanced Productivity Across Teams

AI tools process transactions and analyze data far faster than humans. Consequently, teams can manage larger workloads, meet tighter deadlines, and maintain accuracy—all of which improve overall productivity. - Personalized Customer Experiences

AI’s ability to analyze customer behavior allows financial institutions to create tailored interactions. For example, AI can recommend financial products based on individual spending habits. Furthermore, this personalization deepens customer trust and loyalty over time. - Strengthened Risk Management

With its unparalleled ability to detect anomalies, AI helps organizations mitigate risks and combat fraud. Thus, financial institutions can enhance their security measures and protect their customers more effectively.

Preparing for the Workforce Impact of AI

To fully harness the benefits of AI, organizations must prepare their workforce for this transformation. Here’s how:

- Upskilling for the Future

Investing in employee development is crucial. Offering training in data analysis, machine learning, and AI ethics equips workers with the skills they need to stay relevant. - Creating Collaborative Roles

Rather than replacing humans, AI can enhance their roles. For example, financial advisors can use AI insights to provide clients with more informed and tailored recommendations, fostering trust and satisfaction. - Fostering a Growth Mindset

Encouraging employees to view AI as an opportunity rather than a threat fosters innovation. Additionally, it creates a culture of continuous improvement and adaptability, which is essential for long-term success.

The Future of AI in Financial Services

The future of AI in financial services holds tremendous potential for growth and innovation. Predictive analytics will revolutionize investment strategies, while blockchain combined with AI will fortify security systems. Furthermore, AI-powered platforms are likely to expand access to financial services, making them more inclusive for underserved communities.

However, ethical concerns must be addressed as well. Transparency in algorithms and unbiased data usage are critical to maintaining trust. Meanwhile, a customer-first approach ensures that the adoption of AI benefits everyone involved.

Conclusion: Embracing Workforce Impact and the Future of AI

The workforce impact and the future of AI are transforming financial services in profound ways. While challenges such as reskilling and ethical considerations exist, the opportunities to enhance efficiency, improve customer experiences, and drive innovation are immense. By preparing their workforce and embracing AI strategically, financial organizations can lead the way into an exciting and prosperous future.

Contact Us

Want to explore how AI can revolutionize your financial services operations? Contact us today to discover how we can help you navigate this transformation with tailored solutions for your business.